How Long Should I Keep Records Before Shredding?

Knowing when to destroy old documents is just as important as knowing how to store them securely. Many Australians keep paperwork far longer than necessary — increasing the risk of identity theft, privacy breaches, and clutter.

So the big question is:

How long should you keep records before shredding?

The answer depends on the type of record: personal, financial, tax, or business documents all follow different retention rules. This guide explains what to keep, what to shred, and when it’s safe to securely dispose of your records in Australia.

Why Record Retention Matters

Keeping documents too long can be risky. Old paperwork contains personal and financial information that criminals can exploit. At the same time, destroying records too early can create legal or tax problems.

Proper record retention helps you:

- Protect personal information

- Stay compliant with Australian regulations

- Reduce identity theft risks

- Avoid unnecessary clutter

- Maintain organised records

Secure shredding is the safest way to dispose of expired documents.

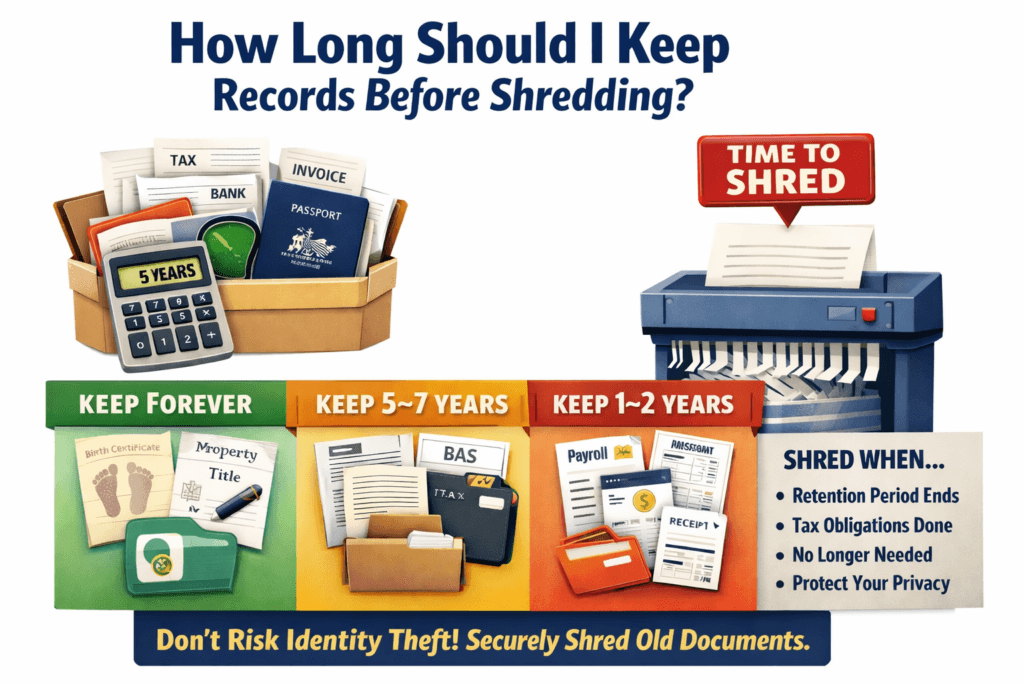

How Long Should You Keep Personal Records?

Personal records vary widely in importance. Some documents should be kept forever, while others can be shredded after a few years.

Keep Forever

These documents should never be destroyed:

- Birth certificates

- Marriage certificates

- Divorce papers

- Wills and estate documents

- Property titles

- Adoption papers

- Citizenship documents

Store these in a fireproof safe or secure digital archive.

Keep for 1–2 Years

Short-term records include:

- Utility bills

- Bank statements

- Credit card statements

- Pay slips

- Household receipts

Once verified and no longer needed, these can be safely destroyed.

Keep for 5–7 Years

These documents are linked to tax or legal obligations:

- Tax returns and supporting documents

- Investment records

- Loan agreements

- Major purchase receipts

- Insurance claims

- Medical records (in many cases)

After this period, they can usually be securely shredded.

How Long Should Businesses Keep Records in Australia?

Businesses face stricter retention requirements.

According to Australian record-keeping standards, most business financial records must be kept for at least 5 years. This includes:

- Tax documentation

- Employee payroll records

- Contracts and invoices

- Business activity statements (BAS)

- Superannuation records

- Financial reports

Some industries require longer retention periods, especially in healthcare, legal services, and government-regulated sectors.

When retention deadlines expire, secure document destruction is essential to comply with privacy obligations.

When Is It Safe to Shred Documents?

You can shred records when:

- Legal retention periods have passed

- Tax obligations are complete

- Warranty or dispute periods are over

- Information is no longer needed for reference

Never throw sensitive documents in the regular bin. Even torn paperwork can be reconstructed.

Professional shredding ensures documents are destroyed beyond recovery.

The Privacy Risks of Keeping Old Records

Old files sitting in cupboards or storage boxes are a common source of data breaches.

Paper documents contain:

- Names

- Addresses

- Bank details

- Tax file numbers

- Medical information

- Business data

Under Australian privacy expectations, both individuals and businesses have a responsibility to protect personal information — even when disposing of it.

Secure shredding is part of responsible data protection.

Secure Shredding vs DIY Shredders

Home and office shredders often jam, overheat, or leave readable fragments. Professional shredding services provide:

- Industrial-grade destruction

- Secure chain of custody

- Locked collection bins

- Certificates of destruction

- Compliance with privacy standards

This is especially important for businesses handling sensitive client data.

A Simple Rule of Thumb

If you haven’t needed a document in years and it contains personal or financial information, it should be reviewed for secure destruction.

Regular document clean-outs reduce risk and free up space.

Many households and offices schedule annual shredding days to stay organised and compliant.

Frequently Asked Questions

Can I throw old bank statements in the bin?

No. Bank statements contain sensitive personal information and should always be shredded.

How long should I keep tax records in Australia?

At least 5 years after lodging your return. Businesses may need to keep them longer depending on circumstances.

Should I shred utility bills?

Yes. Utility bills contain personal details that could be used for identity theft.

Is it safe to burn documents instead of shredding?

Burning is unreliable and often incomplete. Professional shredding guarantees destruction.

What documents should never be shredded?

Permanent identity and legal records like birth certificates, wills, and property titles.